Still not earning passive income on your crypto?

With traditional staking, liquid staking, and DeFi staking platforms emerging everywhere, determining where to stake crypto safely and profitably in 2026 has become a challenge. Each platform offers the best annual percentage yield (APY), lowest fees, and flexible lock-up periods. Still, minimum staking requirements, confusing terms, and inconsistent rewards make it hard to know where to start.

In this equation, you risk locking your staked tokens on the wrong platform, facing lengthy staking durations with minimal returns. Worse, not all custodial staking platforms are transparent or even safe. And if you’re juggling between proof-of-stake chains and centralized staking options, the complexity only grows.

We evaluated the top crypto staking sites across several key metrics: APY, minimum staking amount, supported crypto assets, auto-staking features, and cross-chain compatibility. Whether you’re into liquid staking tokens or want simple, earn passive income setups, this guide breaks down the 6 best platforms to stake crypto in 2026, so you can stop researching and start earning.

Table of contents

6 Best Crypto Staking Platforms to Earn Passive Income

Crypto exchanges are among the best platforms that offer staking services, providing user-friendly interfaces and robust security features. Choosing reputable exchanges for staking ensures the safety of assets and the potential for high yields. These exchanges also offer both beginners and experienced investors various tools and opportunities.

In addition to staking, many of these exchanges also support advanced derivatives trading, see our guide to the best futures trading platforms for a full comparison

Quick Overview | |

|---|---|

| Binance | Best For: Our top pick for crypto staking in 2026 APY Range: ~0.2% to 25% + (varies by asset and lock period) Supported Coins: 300+ coins, including ETH, BNB, ADA, SOL Auto-Staking: Yes (for selected assets) Cross-Chain: Partial (BNB Smart Chain, ETH, etc.) |

| Nexo | Best For: auto-staking and instant yield APY Range: ~4% to 14% + (higher with NEXO rewards) Supported Coins: 60+ assets, mostly large-cap Auto-Staking: Yes (default behavior) Cross-Chain: No |

| Bybit | Best For: transparent APYs and short-term flexibility APY Range: ~0.8% to 500% + (varies widely) Supported Coins: 200+ coins, including new listings Auto-Staking: Yes (via Earn products) Cross-Chain: No |

| Gate.io | Best For: accessing hard-to-find altcoin staking APY Range: ~0.1% to 500% + (on promo or new tokens) Supported Coins: 200+, including small-cap and DeFi Auto-Staking: No Cross-Chain: Partial (some DeFi options) |

| KuCoin | Best For: passive income on emerging tokens APY Range: ~0.01% to 777% + Supported Coins: 269+ coins, including early-stage projects Auto-Staking: Yes (for soft staking) Cross-Chain: No |

| Kraken | Best For: Security and compliance-focused users APY Range: ~0.25% to 12% Supported Coins: 24 major assets (ETH, DOT, ADA, etc.) Auto-Staking: No Cross-Chain: No |

1. Binance, Our Top Pick for Crypto Staking

Launched in 2017 by Changpeng Zhao (CZ), Binance has grown into the largest crypto exchange by trading volume and now leads the staking space. Its staking services fall under the Binance Earn umbrella, offering users an intuitive way to earn passive income across a wide range of tokens. Binance also boasts advanced trading features that enhance trading efficiency and flexibility, catering to novice and experienced investors. What stands out is how Binance simplifies staking without compromising on returns or asset variety.

Staking on Binance covers flexible and locked terms, with transparent APY rates for over 300 crypto assets. It also offers DeFi staking for users who want exposure to on-chain yields without directly managing wallets or interacting with protocols. Binance supports ETH 2.0 staking with no validator setup, and its auto-staking feature lets users reinvest rewards seamlessly.

We recommend Binance because it offers high-performing APYs, deep liquidity, and broad token support. In our test, the platform’s UI made it incredibly easy to locate staking offers, compare yields, and manage redemptions. Plus, customer support responded in under 5 minutes through live chat, which was among the fastest we’ve seen.

One Redditor said it well: “I don’t even bother looking elsewhere anymore. Binance always has one of the top yields, and I get to sleep at night knowing it’s not some sketchy app.” That combination of yield performance and peace of mind puts Binance at the top of our list.

Key Features for Staking Users on Binance | |

|---|---|

| Diverse Staking Options | You can choose from locked staking, DeFi staking, and ETH staking to suit different risk appetites and investment strategies. |

| Wide Range of Supported Assets | Stake various cryptocurrencies, including ETH, ADA, BNB, MATIC, and more. |

| Clear APY Display | Transparent yields and terms for each asset. |

| User-Friendly Interface | Simplified staking process with just a few clicks, suitable for beginners and experienced users. |

| No Staking Fees on Binance Earn | Maximize your rewards without worrying about additional fees. |

| Regular Updates and Additions | Continuous addition of new staking assets and features to enhance the user experience. |

2. Nexo, Best for Auto-Staking and Instant Yield

Nexo was launched in 2018 and was founded by Antoni Trenchev and Kosta Kantchev. While it isn’t strictly a DeFi platform, its Earn product mimics staking, letting users accrue interest on assets without the hassle of lockups or gas fees. Unlike staking, crypto lending on Nexo involves loaning out your digital assets to earn interest, which can offer different rewards and liquidity options. We consider Nexo our second-best pick for staking because it makes crypto earning both passive and frictionless.

The platform offers APYs up to 14%, especially when paid in NEXO and tied to the loyalty program.

What stands out is the daily payout with compounding and the ability to withdraw without penalties, which is ideal for users who prefer flexibility over max yield.

Nexo supports over 60 major assets, has strong community feedback on Reddit (particularly for reliability and fast withdrawals), and enforces top-tier security protocols, including BitGo custody, ISO/IEC 27001 certification, and a $375 million insurance fund.

In our own support tests, we received responses via email in under 24 hours, though live chat was limited and slower during high-traffic periods.

We recommend Nexo for users who want steady, predictable earnings without worrying about technical setup or locking their tokens. It’s great for long-term holders who value consistency and a hands-off approach.

Key Features for Staking Users on Nexo | |

|---|---|

| Daily Compound Interest | Earnings are credited daily and compounded, boosting passive income potential. |

| No Lockups Required | Earn while keeping your assets liquid and accessible. |

| Tier-Based Yields | Loyalty levels influence your APY, offering better rates for holding NEXO tokens. |

| In-App Swaps + Earn | Combine earning and swapping within the same dashboard. |

| Insured Custody | Assets are held in insured wallets, increasing user confidence. |

3. Bybit, Best for Transparent APYs and Short-Term Flexibility

Bybit, founded in 2018, is primarily known for its derivatives exchange, but it’s quickly become a go-to platform for fixed-term staking through Bybit Earn. What sets Bybit apart (and why we rank it third) is the combination of clean UX, fixed-term yield predictability, and rotating token campaigns.

Staking options include flexible savings and locked staking, with APYs ranging from 0.8% to 500 %+, depending on the token and duration. High-yield offerings tend to be short-term and tied to launchpool-style events. Crypto assets like DOT, SOL, and ETH are frequently featured. Users can stake assets for 7, 14, 30, 60, or 120 days, with clear expectations and automatic redemption if selected. The staking duration directly impacts the APYs, encouraging users to consider both the types of assets and their staking duration to maximize returns.

While the platform doesn’t support automatic compounding during a staking term, you can restake after the term ends. Bybit also supports multiple networks (like Arbitrum and Optimism) for deposits, which makes it more versatile for users with L2 or altchain tokens. Fees are zero for staking itself, and APYs are visible upfront, something Redditors often praise for transparency.

Customer support in our testing was fast via live chat (under 10 minutes during working hours) and helpful for staking-related questions. The documentation was also clear for first-time takers.

We recommend Bybit for users looking for predictable, locked returns with a simple and intuitive interface, especially those who prefer set durations and visible yields over flexible products.

Key Features for Staking Users on Bybit | |

|---|---|

| High-Yield Locked Options | Earn more when committing for 30 to 120 days. |

| Flexible and Fixed Terms | Choose how long to stake or earn based on your risk appetite. |

| Clear APY Display | Transparent yields and terms for each asset. |

| Beginner-Friendly Dashboard | Simplified for new users entering the staking game. |

| Occasional Launchpad Bonuses | New tokens with yield boosts for early participants. |

4. Gate.io, Best for Accessing Hard-to-Find Altcoin Staking

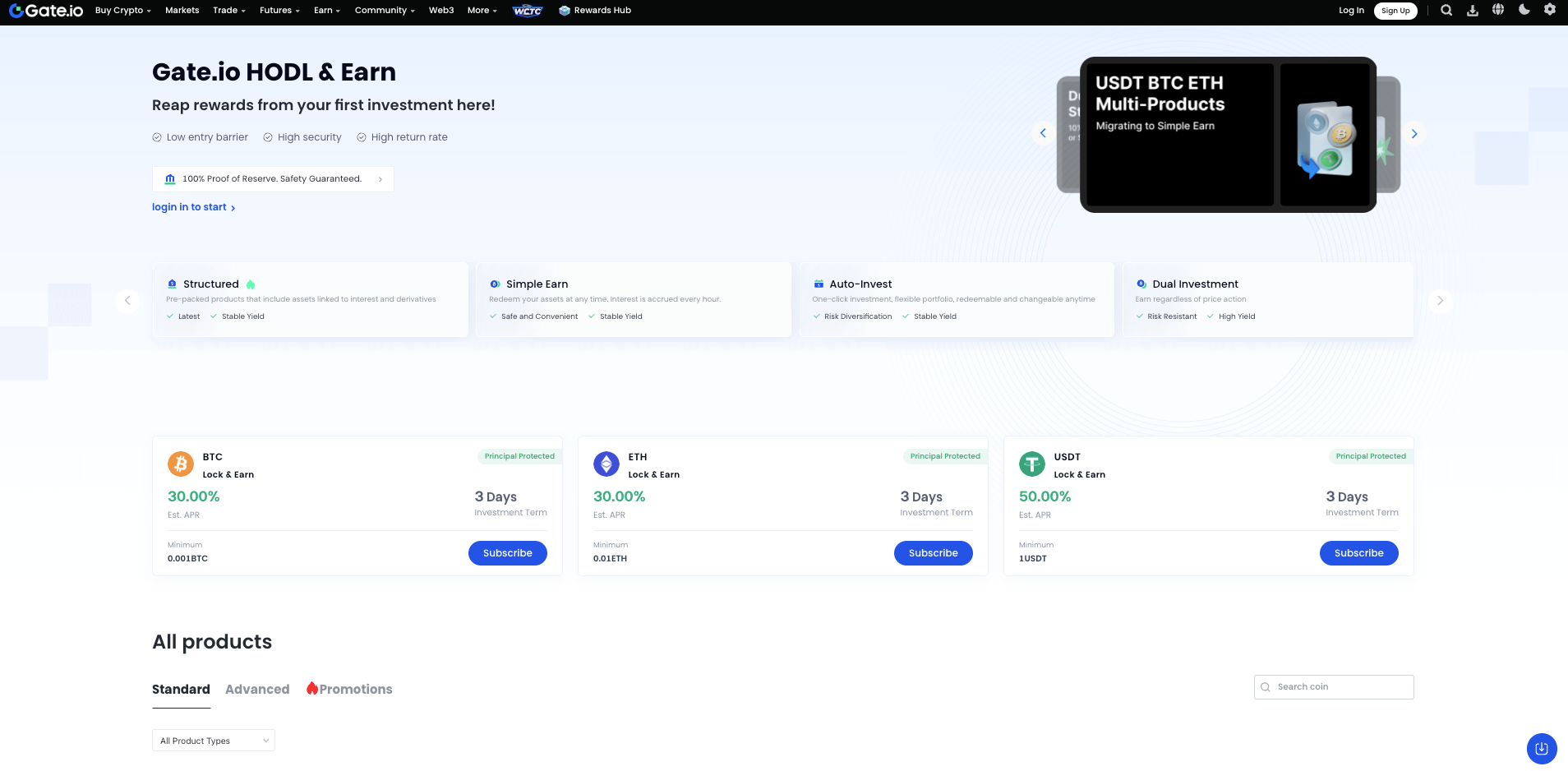

Gate.io has been around since 2013 and offers the most extensive variety of staking products among centralized exchanges. Its Gate HODL & Earn section includes flexible staking, locked-term savings, DeFi staking, and ETH 2.0 staking, making it especially appealing for power users. We place it fourth, not due to lack of features, but because the interface can overwhelm beginners.

Over 200 assets are supported, including mainstream coins and niche tokens like CHZ, KAVA, and AXS. Some DeFi staking campaigns reach 20 %+ APY, though these are often capped and time-limited.

Unlike Nexo or Bybit, Gate lets users participate in on-chain staking via a custodial interface, sometimes including auto-restaking depending on the token.

Cross-chain compatibility is solid, with staking products accepting assets from Ethereum, BNB Chain, and Avalanche. However, users must manually opt in to many campaigns, and the dashboard isn’t always intuitive. Redditors love the selection but often mention limited customer support and confusing staking mechanics. Our tests echoed this: tickets were answered, but live chat was unavailable during weekends, and responses took up to 48 hours.

Gate.io is perfect for users who want access to less common staking tokens, DeFi-style campaigns, and advanced features. Just be ready for a steeper learning curve.

Key Features for Staking Users on Gate.io | |

|---|---|

| Broad Token Selection | Support hundreds of digital assets, including niche altcoins. |

| DeFi Integration | Occasionally runs campaigns tied to on-chain staking protocols. |

| Clear APY Display | Transparent yields and terms for each asset. |

| Flexible & Locked Terms | Tailored staking strategies based on your preferences. |

| ETH 2.0 Staking Support | Stake ETH without managing your validator node. |

| Auto-Renewal Options | Reinvest earnings automatically for selected assets. |

5. KuCoin, Best for Passive Income on Emerging Tokens

KuCoin launched in 2017 and quickly became a favorite among traders looking for low fees and access to emerging tokens. Regarding staking, KuCoin Earn delivers a versatile experience that includes flexible staking, locked terms, and dual investment products. KuCoin also helps users manage a diversified staking portfolio, making earning rewards from various cryptocurrencies easier. We rank KuCoin as our fifth-best staking platform for its advanced tools, wide token selection, and custom strategies.

The platform supports staking on over 269 assets, including ETH, DOT, ATOM, and native platform tokens. Yield rates vary: flexible staking usually offers 2–6%, while fixed terms and structured products can climb past 10%, particularly in market-neutral investments. Dual investment, one of KuCoin’s standout features, gives users fixed returns while betting on price targets, which can appeal to users comfortable with more complexity.

KuCoin also offers ETH 2.0 staking with a low entry barrier, although it’s not as visible or beginner-friendly as on Binance or Kraken (which we will discuss below). Users must manually opt in and track earnings, which can be a downside for passive stakers.

We also ran several support tests. Responses via chat were delayed (up to 12 hours for simple queries), and the documentation didn’t always clarify staking mechanics. Redditors often point out that while KuCoin offers solid APYs, the UX can feel cumbersome, and the lack of live support is frustrating.

We recommend KuCoin for intermediate to advanced users who want more control and options and are willing to explore structured products for higher yield.

Key Features for Staking Users on KuCoin | |

|---|---|

| Diverse Staking Options | Supports flexible staking, fixed terms, and advanced products like dual investment. |

| High-Yield Campaigns | Frequently offers limited-time APY boosts on trending tokens. |

| Structured Earning Tools | Access to dual investment and Shark Fin for strategic yield generation. |

| ETH 2.0 Access | Allows staking ETH without minimums or validator setup. |

| Manual Redemption Control | Users can choose when and how to exit locked staking (with limits). |

| Multi-Asset Support | Dozens of PoS and DeFi tokens are available across various chains. |

6. Kraken, Best for Security and Compliance-Focused Users

Kraken, founded in 2011 by Jesse Powell, is one of the longest-standing names in crypto. It’s also the most compliance-focused platform on this list. Kraken is a reliable platform that ensures security and compliance for its users. We place Kraken sixth, not because it lacks quality, but because its staking offering is narrower and conservative, designed for those who value security, regulation, and simplicity above all.

Kraken’s staking program supports around 24 assets, including Ethereum, Solana, Polkadot, and Cardano.

On Kraken, the yields are lower but consistent, and the interface is clean and incredibly easy to use, even for beginners. There’s no gas fee since it’s handled off-chain, and users can unstake certain assets instantly, although ETH remains locked under the standard validator terms.

The platform is regularly audited, fully compliant with US and European regulations, and has never suffered a major breach. Moreover, support in our tests was excellent: live chat was available 24/7 and gave detailed help, including guidance for staking first-timers.

Reddit feedback frequently praises Kraken’s reliability, though users often mention that staking variety is limited compared to other platforms.

We recommend Kraken to users who want a secure platform, are willing to accept lower yields, and prefer simplicity and transparency over high-risk campaigns.

Key Features for Staking Users on Kraken | |

|---|---|

| Regulated ETH 2.0 Staking | Stake Ethereum in a compliant, secure environment. |

| Beginner-Friendly Interface | Clean dashboard with clear staking terms and rewards. |

| Instant Unstaking for Some Assets | Withdraw select tokens without penalty. |

| Secure Platform | Fully audited, U.S.-regulated, with top-tier fund protection. |

| Consistent Yield Structure | Stable APYs without high-risk promotions. |

| Live Chat Support | 24/7 access to real support, not just bots or tickets. |

Methodology: How We Choose the Best Crypto Staking Platforms

Selecting the right crypto staking platforms isn’t something we leave to chance. Understanding the consensus mechanism used by each platform is crucial as it ensures network security and transaction validation. Each platform featured in our list goes through a hands-on evaluation process, based on practical metrics and user-focused features. Here’s what we consider before recommending a platform:

- APY / Yield Performance – We analyze the platform’s annual percentage yield over time, not just short-term promotional rates. Consistency, sustainability, and real user returns are key indicators of quality.

- Token Variety – A strong platform should support a diverse range of staking tokens. Whether you’re holding major digital assets like ETH and SOL or smaller DeFi tokens, more options mean more flexibility for users.

- Fees and Commission – Hidden fees can quietly reduce your earnings. We prioritize platforms with transparent fee structures and competitive commission rates that don’t waste your staking rewards.

- Auto-Staking Features – Platforms that offer auto-staking or compounding help users optimize their yields without manual intervention. We test these features for reliability and ease of use.

- Cross-Chain Support – The best platforms are not limited to a single network. We focus on those that support staking across multiple chains, allowing users to manage assets across different ecosystems with minimal friction.

- Community Reputation – A platform’s standing in crypto is often reflected in its community feedback. We consider reviews and discussions across platforms like Discord, Reddit, and X to gauge real user sentiment and trustworthiness.

- Security and Audits – We only include platforms that have undergone third-party smart contract audits or provide transparent, verifiable safety measures.

FAQ

What is crypto staking?

Crypto staking is the process of locking stake tokens to support a blockchain network and earning staking rewards in return. It’s commonly used in proof-of-stake (PoS) systems and offers a way to earn passive income on crypto holdings.

How does cryptocurrency staking work?

You delegate or lock your crypto assets on a staking platform, which then uses them to validate transactions. You receive staking rewards based on the amount staked and network terms. Some platforms offer flexible or traditional staking options, while others involve custodial or liquid staking.

What are the benefits of crypto staking?

The benefits of crypto staking are numerous, including the potential for high returns, low risk, and the ability to contribute to the security and decentralization of the blockchain network. Crypto platforms offer competitive staking rewards, with some providing annual percentage yields (APYs) of up to 20% or more. Additionally, staking involves locking up assets for a certain period, which can help to reduce market volatility and provide a more stable source of income. Many platforms offer flexible staking options, allowing users to stake their assets for various durations, from a few days to several years.

What are the types of staking?

There are several types of staking, including traditional, DeFi, and liquid. Traditional staking involves locking up assets in a proof-of-stake blockchain network, while DeFi staking involves staking assets in a decentralized finance (DeFi) protocol. On the other hand, liquid staking involves staking assets in a liquid staking platform, allowing users to stake their assets while maintaining control over their private keys. Each type of staking has advantages and disadvantages; the best type for an individual will depend on their specific needs and goals.

Are crypto staking platforms safe?

Most reputable crypto staking platforms are secure, especially those that publish audits and follow compliance protocols. However, custodial staking platforms carry more risk than decentralized or non-custodial options.

Where is the best place to stake your crypto?

The best staking site for crypto depends on your priorities. Binance ranks highest overall for APY and token variety, while Kraken is ideal for a secure, regulated experience. For competitive staking rewards on altcoins, Gate.io and KuCoin are solid choices.

What is the best broker for staking crypto?

Binance is the best broker for staking crypto due to its high APYs, wide token support, and auto-staking options. A crypto staking app can further streamline the process, offering users an easy way to earn rewards while allowing them to carefully evaluate the app’s features and reviews before selecting. It supports both flexible and locked staking for hundreds of digital assets.

Is crypto staking worth it?

Yes, if you choose platforms with transparent APYs and low fees. Staking opportunities abound, with various platforms offering different staking terms, yields, and reward structures. Staking is a low-effort way to earn rewards on your crypto, especially for long-term holders.

Are staking rewards taxed?

Yes, in most countries, earning staking rewards is considered taxable income. Always check your local regulations to understand how this might be reported.

Final Thoughts

Choosing the best staking platforms in 2026 involves more than just considering the annual percentage yield. Yield farming, a method for earning rewards by providing liquidity to various blockchain protocols, is also a key feature to consider. While high APYs are attractive, it’s equally important to weigh staking fees, platform transparency, and available staking methods, whether using liquid staking protocols, traditional staking methods, or exploring on-chain staking options.

Crypto staking can be a smart way to grow your holdings, but it’s not risk-free. Your staked funds may be subject to staking period lockups, network volatility, or security flaws if robust security measures aren’t in place. Unlike traditional staking, some off-chain staking platforms don’t give you full control of your assets.

Stick to platforms that disclose fees, offer a wide range of staking pools, and support both custodial and non-custodial options. Whether you’re after convenience or control, smart staking ultimately comes down to understanding the fine print and selecting tools that align with your long-term goals.