Crypto options trading is booming, but choosing the right platform still feels like a gamble for many traders. You go to start trading, and suddenly you’re unable to access the website, hit with a “Cloudflare Ray ID found” error, or blocked by an unexplained security service. Worse, you might encounter issues that seem to be triggered by a certain word, malformed request, or internal SQL command, leaving you stuck while the site owner tries to resolve it.

These aren’t just rare bugs. Poorly optimized platforms often expose users to unnecessary risk, failed withdrawals, and weak infrastructure that can’t handle several actions simultaneously. You may be operating in a volatile exchange environment, only to be sidelined by delays, errors, or tools that weren’t built with real-world exposure or security in mind.

To help you trade smarter, we’ve analyzed dozens of platforms and narrowed them down to the 5 best crypto options trading platforms. These platforms are built to handle complexity, support fast execution, maintain uptime under stress, and minimize errors that often leave traders locked out or exposed. Let’s dive in!

Table of contents

5 Best Crypto Options Trading Platforms | |

|---|---|

| Binance | Best For: Overall for High-Liquidity Multi-Asset Options Trading Options Model: European-style Fees: 0.02% maker/taker Margin: Cross & isolated supported KYC: Required |

| Crypto.com | Best For: Mobile & Secure Access Options Model: European-style Fees: 0.075% maker/taker Margin: Spot-based only KYC: Required |

| Bybit | Best For: Stablecoin-Settled Flexibility Options Model: European-style Fees: 0.020% maker/0.030% taker Margin: USDC-based cross margin KYC: Required |

| OKX | Best For: Institutional-Grade BTC & ETH Options Options Model: European-style Fees: ~0.030% maker/taker (volume-based) Margin: Standard & portfolio margin KYC: Required |

| Deribit | Best For: Pro BTC/ETH Options Traders Options Model: European-style Fees: 0.00% maker / 0.05% taker Margin: Standard & portfolio margin KYC: Required |

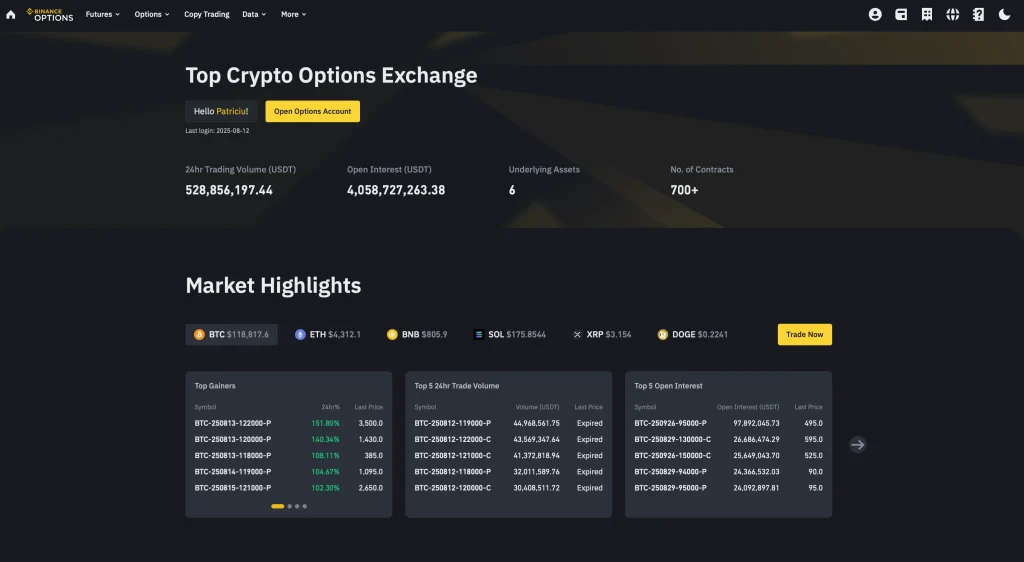

Binance – Best Overall for High-Liquidity Multi-Asset Options Trading

Binance stands out as the best crypto options trading platform due to its deep liquidity, extensive toolset, and global reputation for security and performance.

It supports European-style options and offers access to major crypto assets, including BTC, ETH, BNB, SOL, and XRP.

Security-wise, Binance enforces mandatory KYC verification, employs Cloudflare Ray ID protection against online attacks, and utilizes multi-layer account security, including 2FA, cold storage, and real-time IP address tracking.

Regarding fees, Binance applies a maker-taker fee of 0.02% for options, significantly lower than traditional options trading platforms in Canada or the USA. No hidden costs are applied for settlements, and its UI enables seamless navigation between options, futures, and spot markets, with additional access to Binance Earn for managing unused capital.

Redditors often point to Binance’s reliability, especially for BNB pairings and BTC options, with minimal latency and highly responsive support.

Crypto.com – Best for Mobile & Secure Access

Crypto.com is among the best crypto options trading platforms for its intuitive mobile experience, tight integration across financial products, and institutional-grade security. It supports European-style cryptocurrency options, which are ideal for retail traders seeking simplicity and fixed-risk strategies.

As of 2026, Crypto.com offers options trading on top crypto assets, including BTC, ETH, CRO, SOL, and MATIC. This is a solid selection but smaller than that of competitors like Binance.

Security is one of Crypto.com’s strongest pillars. The platform maintains ISO/IEC 27001:2013, SOC 2 Type II, and PCI-DSS compliance, and user assets are kept in cold storage via Ledger Vault, with MFA, IP whitelisting, and Cloudflare Ray ID protection used to mitigate malicious attacks. KYC is mandatory to access all trading functions, including crypto options.

Redditors often praise Crypto.com for its easy onboarding, clean UI, and mobile-first tools, but express mixed feedback on liquidity for less popular option pairs.

Fee-wise, Crypto.com offers competitive pricing. The base maker fee is 0.075% and the taker fee is 0.075%, with up to 50% discount available for high-volume traders or those staking CRO tokens.

Bybit – Best for Stablecoin-Settled Flexibility

Bybit is a strong choice for crypto options traders who value low fees, fast execution, and clean user interfaces.

The platform offers European-style options on major digital assets like BTC, ETH, and SOL, using USDC as both margin and settlement currency. This simplifies portfolio management for stablecoin-based strategies. Contracts settle automatically at expiration, with a time-weighted price calculation for fairness and transparency.

Fee-wise, Bybit is highly competitive. Standard rates start at 0.020% for maker orders and 0.030% for taker orders, with tiered discounts available to active or VIP traders.

On the security front, it features cold wallet storage, 2FA, and full KYC compliance, creating a safe environment for retail and institutional participants.

Community feedback, particularly on Reddit, is generally positive: users highlight the platform’s responsiveness during volatile conditions and its intuitive web and mobile experience.

OKX – Best for Institutional-Grade BTC & ETH Options

OKX stands out in 2026 as a top-tier platform for BTC and ETH crypto options trading, built for traders who value precision, deep liquidity, and institutional-grade infrastructure.

It offers European-style options only, settled at expiration, with flexible expiries (daily to quarterly). The platform integrates seamlessly with margin tools and pro-level analytics like options chains, Greeks, and an RFQ block trading system.

Security is robust, featuring 2FA, cold wallet storage, and Cloudflare Ray ID protection, alongside full KYC and regulation across the U.S., EU, UAE, and Asia.

Fees follow a transparent, tiered model: base users pay 0.030% maker/taker, while high-volume or VIP traders can access lower or negative fees. OKX also recently lowered fee caps and exercise/liquidation thresholds, improving efficiency for active traders.

Reddit users frequently highlight OKX’s execution speed and institutional-grade UI, though they note the limited range of supported options assets.

Deribit – Best for Pro BTC/ETH Options Traders

Deribit is the go-to destination for experienced crypto options traders focused on Bitcoin and Ethereum derivatives.

Specializing in European-style options, Deribit offers contracts that settle at expiration, which is perfect for clean, predictable risk management.

The platform is renowned for its deep liquidity and low-latency execution, backed by a robust, institutional-grade infrastructure and a global user base. In May 2025, Coinbase entered a strategic acquisition agreement with Deribit, confirming its dominant position in crypto derivatives.

Deribit’s fee structure is clear and competitive: makers pay 0.00%, while takers are charged 0.05%. Discounts are also available on complex multi-leg option combos through option combo fee adjustments.

Security is a top priority: most funds are secured in cold wallets, 2FA is mandatory, and the platform maintains broad safety protocols and an insurance fund to protect users. Deribit also supports standard and portfolio margining, allowing traders to optimize capital use across futures and options.

Methodology: How We Chose the Best Crypto Options Trading Platforms

To identify the best crypto options trading platforms, we conducted a multi-layered analysis focused on real-world usability, safety, and strategic benefit to active crypto traders. Our evaluation considered over a dozen platforms and was structured around the following essential criteria:

1. Security Standards & KYC Verification

Each platform was assessed for security solutions such as cold wallet storage, 2FA, and IP address monitoring. We prioritized platforms with a solid track record of defending against online attacks, DDoS threats (e.g., Cloudflare Ray ID protection), and misuse of user data. KYC verification requirements were noted to understand the level of account protection and regulatory compliance.

2. Liquidity & Market Depth

We gave significant weight to deep liquidity, especially in BTC, ETH, and popular altcoin contracts. Platforms that enable smooth margin management, support large-volume crypto futures trading, and provide tight bid-ask spreads in the Bitcoin market were ranked higher. Liquidity directly impacts the ability to trade options effectively without price slippage.

3. Fees, Collateral, and Settlement Models

Transparent fee structures were essential. We analyzed maker/taker fees, discount tiers, and combo pricing logic. Platforms with flexible settlement (e.g., USDC, BTC, ETH) and low-cost options contracts that benefit both short-term and long-term strategies were rated higher.

4. User Experience & Community Feedback

We included Reddit, Twitter, and trading communities’ feedback to factor in real trader sentiment. Platforms praised for fast execution, responsive UIs (especially mobile), and consistent support scored higher. We excluded platforms blocked in key regions or where performance security concerns were raised due to system overloads or malformed data handling.

FAQ

What is crypto options trading?

Crypto options trading allows investors to buy or sell the right, but not the obligation, to trade cryptocurrency at a set price on a future date.

Can you trade options on cryptocurrencies?

You can trade crypto options on various cryptocurrency trading platforms, including well-known players like Binance. These platforms offer, among others, Bitcoin options, BNB pairings, and altcoin contracts.

Do I need to complete KYC to trade crypto options?

Most crypto options trading platforms require KYC verification, especially those operating in regulated markets like the USA or Canada. However, some DeFi options trading platforms may offer trading without KYC.

How do you trade F&O in crypto?

To trade crypto futures and options (F&O), you must register on a crypto trading platform, complete KYC, deposit funds, and access contracts with leverage or hedging tools. Deep liquidity is essential for short-term trades.

What’s the difference between European and American-style options?

European-style options can only be exercised at expiry, while American-style options allow early execution. Most crypto options on global platforms follow the European model for simplified settlement.

What is the main advantage of European-style options in crypto trading?

European-style options are generally cheaper and more stable than American-style options. Since they can only be exercised at expiration, they’re less prone to price manipulation and have lower trading fees. This makes them ideal for traders focused on strategic expiry-based plays rather than short-term price swings.

Can I benefit from market moves before expiration with European options?

Not directly. With European-style contracts, you cannot exercise the option early, even if the market moves in your favor. However, you can still sell the contract on the platform before expiry (if it’s liquid), allowing you to capture potential gains indirectly. The key is to plan around the expiration date rather than reacting to mid-term price action.

What is the difference between crypto options and futures?

Crypto options give the right to trade an asset, while futures are obligations. Options are often used to protect portfolios or speculate with limited risk, whereas futures expose traders to higher margin and leverage risk.

Final Thoughts

Choosing the right crypto options platform isn’t just about low fees or asset variety, but about trusting the services that power every trade. Every action should feel seamless when you sign into a reliable platform. If a single phrase or input can break functionality or trades aren’t performed as expected or triggered on time, that’s a red flag.

Stick with platforms built to handle complexity without compromise, and you’ll trade with confidence, not uncertainty.